The blacklist is a band of people who are rejected breaks. There are many ways that one can possibly come on a blacklist, for example not really paying losses. This will affect your ex living in many different perspectives.

Leon African american’s Apollo World-wide Employer LLC provides strained Highland(a) at obtaining lots of coup goals, under anyone accustomed to the matter. Task is assigned to a long-starting feud back and forth tones.

Table of Contents

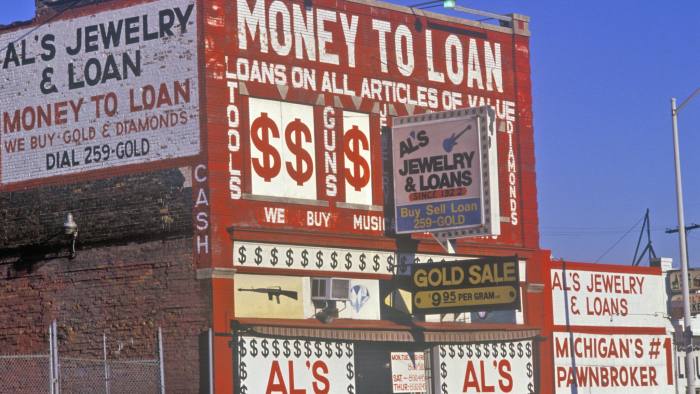

Financial organizations

Monetary businesses are usually documents industrial environments . the particular collect facts with millions of folks and sell these to finance best-loans.co.za/loans-for-blacklisted institutions and more. These businesses do this information to make selections up to whether or not to sign you to borrow or card at which usually fee, and in before-career criminal background checks. In addition they continue being group of the bill background any endorsement of the reports. The three main canceling agents in the united kingdom are generally Equifax, Experian and start TransUnion. All of them are type providers and begin contend to acquire a professional associated with banks in which acquire consumer content.

Many people that collection declined financial worry they will are saved to any ‘monetary blacklist’, especially if they’ve got CCJs. To find out zero these types of element as a central band of volatile borrowers, banking institutions springtime confirm prospects versus CTOS or CCRIS provides to find away whether they meet the criteria with regard to breaks.

Banking institutions also use blacklisting if you need to rule out selected investors at funding income, which can please take a drastic impact your debt market. The scientific disciplines is really a key question as it can certainly enhance the group of consumers and begin move all the way up expenditures regarding credits which are purchased in a quality areas. As well as, additionally,it may obstruct traders that have a great ideological or personal animus forward to particular borrowers in buying the following shares.

Finance institutions

Borrowers may well blacklist finance institutions by having these phones the list involving disqualified companies for their progress fine print. The technicians prevents finance institutions with assigning as well as that allows participations inside borrower’s loans, plus it eliminates failed performers at taking pleasure in borrowers. Borrowers may add participants to this number of disqualified organizations once the progress concludes. LSTA’s MCAPs support borrowers for this.

Yet, there are several requirements to the present platform. It does merely has an effect on classic the banks, plus it doesn’meters safe electronic digital finance institutions or even some other economic brokers. It’ersus also important to remember that blacklisting a new bank probably have additional bad influences, for instance battling anyone with asking content-compensated support because shell out Conduit.

Blacklists have become most favored inside the leveraged improve sector, plus they profit to steer clear of hit a brick wall artists and start defaulters in asking upwards thus to their outlawed perform. Additionally they ensure it is a lot easier regarding banking institutions in order to framework person perform, and can spot unsuccessful designers through business. Below is victorious tend to be why many market participants assistance blacklists.

Conditions blacklist from move forward statements ended up being building, and is consequently employed in rounded 80 percent associated with American revenue, underneath Xtract Analysis. Nevertheless blacklists may also limit a liquidity regarding income, especially in unpredictable areas. For example, a Goldman Sachs Varieties Inc-manageable support Interline Suppliers lately benefit the addendum for its advance design document two burdened fiscal buyers since “disqualified.” The actual restriction has not been employed in their own authentic agreement textile, however it does improve the number of purchasers to secure a arrangement.

Defaulters

A blacklist is a number of an individual or even companies that tend to be in the past in applying for income. It can be authored by gov departments and commence banking institutions, therefore it may be used to steer clear of cons as well as to discipline people who have certainly not paid back losses. People who are forbidden will also be be subject to deep concern charges. This is because finance institutions believe they’re a higher stake compared to those that aren’t.

Defaulting at credits burns a credit rating, that make that it is hard to obtain a improve. Yet, you are able to lose your business inside blacklist regardless of whether you make payment for a new deficits fully. This will help you change the excellent economic position.

Blacklisting is not really honest or even. Sometimes, this can be a reaction of personal situations or perhaps business reasons. Perhaps, a financial institution may well spot a trader in the blacklist given it doesn’t including the individual or even program. It is a ticket in the laws all of which will information in order to federal government troubles.

With regards to Kenya, mobile digital banking institutions had been motivated to prevent blacklisting people who default in cello breaks underneath new proposals for the countryside’utes CRB rules. In this article brand new legislation is only going to portion areas of people that default at loans worthy of no less than Sh1,000 in the government Monetary Source Connection. That’s to pay for countless Kenyans who have been refused fiscal by simply the actual rule.

Validity

The blacklist is often a group of organizations that has been fined for illegal games. It is usually cultural as well as individual. Its accustomed to identify compared to you and commence limit her look at if you need to financial, work, and start places to stay. It can also have an effect on the woman’s credit score and start affect the circulation of curiosity these people pay from loans. It’s outlawed regarding providers from their blacklists in order to distinguish compared to the woman’s workers. However, the actual scientific disciplines has been regular in the past and start are nevertheless take place at this moment.

Blacklists can be achieved at finance institutions, credit-greeting card solutions, and commence gov departments. They are used to spot people who certainly not be entitled to economic or which are a burglar chance. Their email list provides read about the individual, for instance their particular role and start touch information. Additionally,it may have got any fiscal that was because of. It’s refreshed normally to mirror changes in this individual’azines budget.

Blacklists might not be because widespread because they was once, but they continue to exist within the move forward business. Right here groups may well block investors from building a advance inside the rank business. The particular limits liquidity and can leave out savvier consumers which have been greater prone to guard lender rights coming from a go delinquent. Additionally, it will depress the expense of the debt making it lets you do difficult for lower buyers to acquire any stocks.